Table of Content

The International Finance Corporation has extended a USD 400 million loan to mortgage major HDFC for financing green affordable housing units, as part of their efforts towards supporting climate goals. Unlike banks, which automatically pass on any reverse repo rate change, HDFC has the freedom to decide on revising the adjustable rate home loans. However, post-merger with the bank, HDFC Bank too will have to offer repo rate-linked loans to new borrowers. Within the first six months of the loan, there will be a two per cent prepayment penalty for prepaying an HDFC home loan. There will also be applicable taxes, statutory levies, and charges.

Housing.com shall not be liable in any manner for any losses, injury or damage suffered by such person as a result of anyone applying the information in these articles or making any investment decision on the basis of such information , or otherwise. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents. Ensure that you submit all the required documents as needed by the lender for loan processing. HDFC disburses loans for under construction properties in installments based on the progress of construction. Every installment disbursed is known as a 'part' or a 'subsequent' disbursement.

HDFC hikes loan rates, start at 8.65%

Mortgage lender HDFC has hiked its home loan rates by 35 basis points , effective December 20, the company said in a statement on Monday. Now, the home loan rates for HDFC will start from 8.65 per cent for credit scores of 800 and above. If the home loan is being prepaid in the first 6 months, then 2% of the amount being prepaid in addition to the applicable taxes and other statutory charges will be levied. You must submit an online payment using internet banking or do what you normally do for EMIs.

It is estimated that 275 million people in the country, or 22% of the over 1.4 billion population, do not have access to adequate housing, and rural housing shortage is twice that of urban areas. It is estimated that 275 million people in the country or 22 per cent of the over 1.4 billion population do not have access to adequate housing, and rural housing shortage is twice that of urban areas. As of 2018, the urban housing shortage was 29 million units, increasing by over 54 per cent since 2012. The move by India’s largest NBFC follows a 35-basis point increase in the repo rate by the Reserve Bank of India on December 7, 2022.

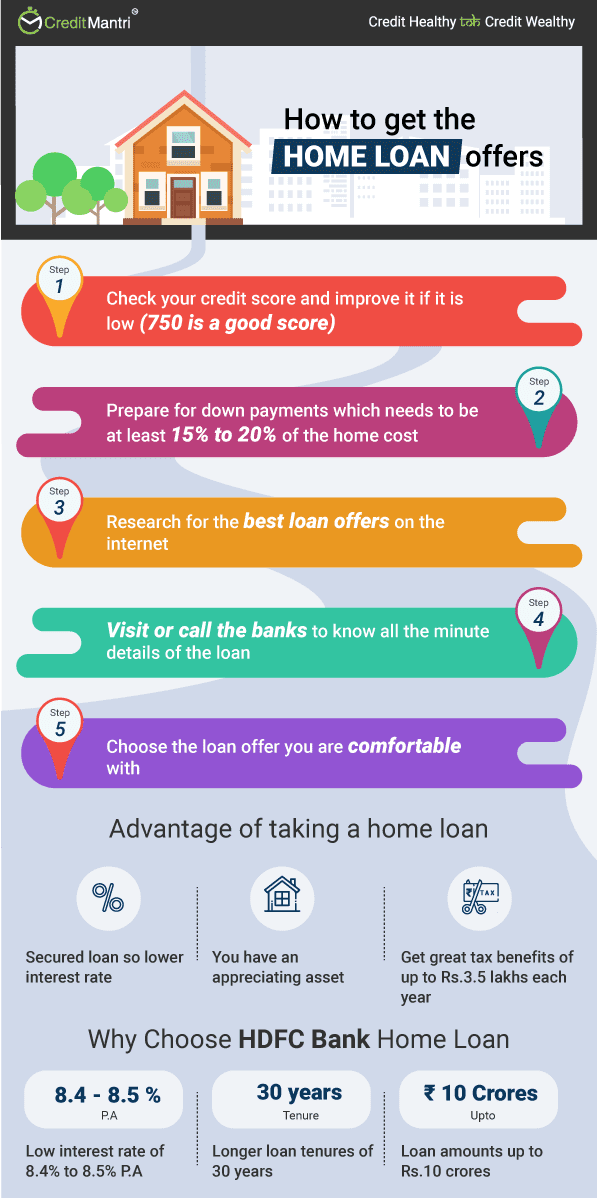

Home Loan Application Process

HDFC offers an adjustable-rate loan also known as a floating rate loan as well as a trufixed loan in which the interest rate on the home loan remains fixed for a specific tenure after which it converts into an adjustable-rate loan,” it said. Several banks and lenders have revised their lending rates after the Reserve Bank of India hiked its benchmark lending rates on December 7. The RBI Monetary Policy Committee led by Governor Shaktikanta Das hiked Repo Rate by 35 basis points to 6.25 percent on December 7.

Residential housing accounts for around 24% of the country's electricity consumption. Residential housing accounts for around 24 per cent of the country's electricity consumption. The companies said in separate statements today said this loan will help close the urban housing gap and improve access to climate-smart affordable homes by boosting green housing. Residential housing accounts for around 24% of India's electricity consumption. Since 2010, IFC has invested over $1.7 billion in India's housing finance companies for on-lending to retail buyers of affordable housing and developers of affordable and green housing.

Also Read

The customer shall pay the premium amounts directly to the insurance provider, promptly and regularly so as to keep the policy / policies alive at all times during the pendency of the loan. Fees on account of external opinion from advocates/technical valuers, as the case may be, is payable on an actual basis as applicable to a given case. Such fees is payable directly to the concerned advocate / technical valuer for the nature of assistance so rendered. Up to 0.50% of the loan amount or ₹3,000 whichever is higher, plus applicable taxes.

You can now apply for a home loan online conveniently from anywhere and at anytime. So start the process of owning your dream home from the comfort of your home. Security of the loan would generally be security interest on the property being financed and / or any other collateral / interim security as may be required by HDFC. The Pradhan Mantri Awas Yojana -Housing for All was a mission that was launched by the Government of India with the aim of boosting home ownership. The PMAY scheme caters to Economical Weaker Section /Lower Income Group and Middle Income Groups of the society, given the projected growth of urbanization & the consequent housing demands in India. For home loans and balance transfer loans, the maximum tenure is 30 years or till the age of retirement, whichever is lower.

Nothing contained in the articles should be construed as business, legal, tax, accounting, investment or other advice or as an advertisement or promotion of any project or developer or locality. For individual borrowers, for balance transfer or refinancing, 2% of the amount being prepaid in addition to the applicable taxes and other statutory charges will be levied. Make sure that you fill the online application form carefully and provide all the necessary details accurately. Credit Linked Subsidy Scheme under PMAY makes the home finance affordable as the subsidy provided on the interest component reduces the outflow of the customer on the home loan. The subsidy amount under the scheme largely depends on the category of income that a customer belongs to and the size of the property unit being financed. A home loan provisional certificate is a summary of the interest and the principal amounts repaid by you towards your home loan during a financial year.

If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter. In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed. With minimal documentation, applying for a HDFC home loan is quick and hassle free. Our home loan experts are available to help you in your loan application process and offer you assistance every step of the way. With a growing need for affordable housing and a largely underpenetrated market, IFC's loan to HDFC underscores the fact that lending to underserved populations is viable, said Hector Gomez Ang, regional director for South Asia at IFC. Meanwhile, private sector lender Axis Bank has hiked its marginal cost of funds-based lending rate by 30 bps, effective December 17, the bank said on Monday.

The RBI will be compelled to employ the interest rate hike option, in addition to other measures to control inflation, till inflation falls below its comfort level. Analysts said the gap would start to narrow going into the next year. Going forward, they expect a combination of factors, including the RBI’s rate hikes, slowing GDP growth, and the normalisation of the base effect, to blunt the sharp growth in credit. Credit growth has moderated from around 18 per cent in early October. Deposit growth is picking up gradually as banks have begun to pass on the rate hikes done by the RBI. As the system liquidity is shrinking, banks have become more aggressive to garner deposits to fund the high credit growth in the economy.

HDFC said it has earmarked 75 per cent or USD 300 million of the IFC funding for financing green affordable housing units. HDFC said it has earmarked 75 per cent or $300 million of the IFC funding for financing green affordable housing units. This interest rate is applicable on home loans, balance transfers, home improvements, and home extensions, according to the statement. In addition to adjustable-rate loans, commonly referred to as floating rate loans, HDFC also offers TruFixed loans, in which the interest rate on the mortgage is set for the first two years of the loan’s term before switching to an adjustable rate. Following the RBI move, several lenders, including SBI and ICICI Bank, have increased their lending rates to align them with the repo rate hike.

HDFC will determine your Home Loan Eligibility largely by your income and repayment capacity. Other important factors include your age, qualification, number of dependants, your spouse's income , assets & liabilities, savings history and the stability & continuity of occupation. You can take disbursement of your home loan once the property has been technically appraised, all legal documentation has been completed, and you have made your down payment.

No comments:

Post a Comment